Pre-issue #2 - Kura Women Summit, Nanbu Bijin frozen Sake, Omachi Summit, passing of Koichi Moriya

Know More. Appreciate More.

Kura Women Summit held in Iga, Mie

From July 21st to 22nd thirty women from eighteen prefectures attended the Kura Women Summit, a gathering of female sake brewery workers, in Iga, Mie Prefecture. Started in 1999 by Rumiko Moriki of Moriki Shuzo, the group gathers every year for a visit to one of their fifty affiliated breweries to exchange ideas and learn from each other in a supportive environment.

This year the group visited Ota Shuzo in Iga, makers of Hanzo. The group remarked on the effective use of space in the small brewery and noted some interesting techniques they'd like to try in their own breweries. Kyoko Tsukamoto of Tamura Shuzo in Tokyo said, "it's our first time back in Iga since the formation of the organization twenty years ago so it's wonderful to see the increase in members since then."

Founder, Rumiko Moriki added,

“compared to when we started in 1999 when sake brewing was still very much a man's world, the working environment for women has greatly improved. These days the industry offers a more comfortable atmosphere for women to work in sake brewing. I hope we can continue to move forward and support each other."

Source + Image: Iga You

Nanbu Bijin release world-first frozen sake

As a way of preserving the absolute pureness of fresh pressed shiboritate sake, brewers at Nanbu Bijin in Iwate have developed new technology that allows them to freeze sake within twenty minutes of bottling without increasing mass (and subsequently breaking the bottle). The idea of frozen sake came about as a way to allow consumers to taste sake as it comes directly off the press.

Although shiboritate sake is nothing new, the time between bottling, shipping, purchase and consumption means that while it is fresh, the active enzymes in unpasteurized sake will have "matured" the sake to some degree.

By freezing the sake to minus 30 degrees celcius straight after pressing, the enzymes are incapacitated, leaving the sake of in a state of suspended animation. Once defrosted, it can be served retaining the characteristics of sake as fresh as it was when pressed directly off the yabuta. As the tag line goes: “The sake remembers the flavor profile from its birth.”

Available for purchase domestically via online channels from August 1 with a price tag of JPY5,400 before tax and shipping.

Source: Excite News

Omachi Summit held in Tokyo

The Okayama Brewer's Association held the 11th Annual Omachi Summit in Tokyo on July 30th with 680 industry players and sake fans in attendance. The first tasting session of the summit included an appraisal by sake industry professionals, with the second session offering consumers an opportunity to meet omachi producers and brewers and taste some of the 215 sake submitted by 134 breweries across the country.

Of the appraised sake, forty-five were awarded for excellence.

Tasting chairperson Hiroyuki Sanmoto said,

“umami, roundness, smoothness, and acidity are the prized characteristics of omachi we were looking for. From Hokkaido to Saga to Oita; I was happy to see so many wonderful sake brewed using omachi from all over Japan.”

Notes from the judges regarding the sake submitted for the summit:

"In the junmai category there were a lot of sake where we felt the same flavor profile could have been achieved with rice other than omachi. We would have liked to see more characteristically omachi-style sake."

"Omachi best displays it's terroir when used with milder yeast strains. Usually in contests a strong impact is a good technique to get a judge's attention but overtly aromatic yeast can over power the simplicity of the rice."

"There were several sake with traces of undissolved carbon dioxide leaving spritzy, tingling sensations that tend to mask the plumpness of omachi. We hope brewers will take care in this area in the future."

Source: SSNP

Sake world mourns the passing of Koichi Moriya

On July 30th the sake industry lost one of its great brewers and nicest people when Koichi Moriya of Asamai Shuzo (Akita) passed away from complications associated with pulmonary thromboembolism at the age of 61.

Moriya embodied the lifestyle of "rice paddies in the summer, sake brewing in the winter". Born to farming family in Hiraka, Akita, Moriya gained his start studying agriculture at Yamagata University, before spending a few years working for the family business.

In 1981 he was invited by an old school friend to join Asamai Shuzo as a brewer. In 1990 after being promoted to toji he became instrumental in bringing Asamai Shuzo's primary label, Ama No To (Heaven's Door) to a wider, audience locally and abroad.

Source: Sakigake | Image: Sake Industry News

The videos below give a glimpse into Asamai Shuzo’s brewing facilities and surrounding areas. They are both in Japanese but certainly convey the beauty of the area as well a sense of Moriya’s passion for brewing.

Click the image above to play this video in vimeo.

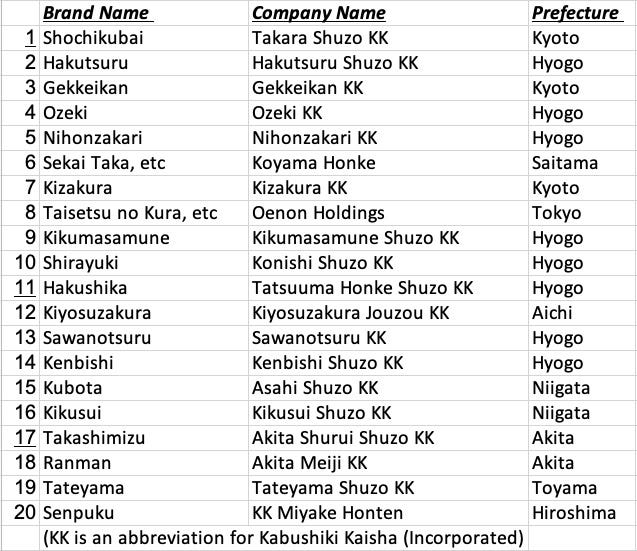

Revenue & Volume: The Big Players of the Sake Industry

By John Gauntner

Anyone working in the wine industry would surely be able to rattle off the top of their head the top five to ten producers of the wines with which they are familiar from the countries in which those wines are produced. This shows the degree of familiarity with the product, and that understanding certainly makes it easier to sell that product.

A major objective of the Sake Industry Newsletter is to facilitate familiarity - to help people that work with sake to get to know the sake-brewing industry in Japan. So it is worthwhile early on to look at the largest producers of sake in Japan.

But even this is challenging to present for three main reasons:

・The relevant data is not released in a timely manner.

・Data is not always based on the same fiscal year for every company involved.

・With some breweries on the rise and others changing their strategy, data changes constantly.

The combination of these three factors means that the list below may not be one hundred percent accurate at this point in time, but it’s close! This list is based on the most recently available data, coupled with an announcement or two that was not reflected in the numbers.

There are two ways to look at this data: volume of production, and revenue. Both are shown below, but it is interesting to keep in mind that while these two lists are similar, there will be variations based on the fact that some brewers brew more low-end sake while others focus more on premium sake. Compare the lists and you’ll notice they are almost identical for the first few sake, but vary more as the list goes on.

Firstly, we have the largest 20 sake producers based on volume and revenue.

BY SALES REVENUE

BY PRODUCTION VOLUME

There are a few interesting observations on all this: Takara Shuzo (a diversified company whose main sake brand is Shochikubai) was number three on the list until this year, but rose to number one based largely on sales of their sparkling sake, Mio, in which they have invested a significant amount of promotional advertising.

Takara overtook Hakutsuru, signaling the first time the top spot has changed in 16 years. Gekkeikan, the current number three, was the industry leader for decades upon decades until Hakutsuru moved ahead of them 16 years ago. Rarely do the top few positions change.

Furthermore, Takara slid into the number one spot even though their sales in 2018 were five percent down from the previous year. How could this be? Because Hakutsuru’s sales were down ten percent for the same period.

Bear in mind both sales revenue and production volume are just one metric. There are strategies beyond our awareness that many of these companies employ for long-term growth.

Also notice two companies have “etc.” in their brand name column. These two, Koyama Honke and Oenon Holdings, own a handful of small breweries all over Japan, each with its own brand name. The position in this list indicates the aggregate of all their sake, made across all their smaller breweries.

Finally, notice the brands Dassai and Born. These two companies have been growing strongly and steadily, firmly ensconcing themselves in the sales revenue lists, but they are not in the top 20 in terms of volume produced.

This is understandable when you take into account both companies focus on more expensive sake, including junmai daiginjo in myriad manifestations. As the unit price of such sake is much higher than that of, say, futsuu-shu, this puts them in the top 20 for revenue but not for volume. Furthermore, bear in mind that these positions may have changed when the absolute most recent data is used.

In truth, scale of operations has no real connection to quality or product appeal. Let us all remember that point! But it is helpful and interesting to know who the largest producers in the industry are.

By John Gauntner